Trying to get a clear picture of your credit health online can sometimes feel like a real puzzle, especially when you're dealing with myequifax.ca. Many folks, just like you, find themselves running into unexpected snags when trying to simply log in or view their credit report. It's a common story, actually, where you know you have an account, perhaps you've even reset your password, but then access just seems to vanish right when you need it most.

It can be quite frustrating, to say the least, when you're trying to stay on top of your financial information and the very system meant to help you puts up roadblocks. Whether it's seeing a message that your credentials are wrong, or being told you don't even have an account despite having one, these little digital hiccups can really throw a wrench into your plans. So, it's almost like you're caught in a loop, trying the same steps over and over with no different outcome.

This article aims to shed some light on these common challenges people face when trying to use myequifax.ca. We'll explore the various issues reported by users and offer some thoughts on what might be happening and what steps you might consider taking. Our goal is to give you a clearer idea of what's going on and, in a way, help you regain control over your credit information, which is pretty important for your financial peace of mind.

Table of Contents

- Common Challenges with myequifax.ca Access

- Getting Your Full Credit Picture

- Discrepancies and Disputes

- Managing Your Credit File: Freezes and Alerts

- When Online Access Fails: What to Do

- Equifax's Ongoing Efforts

- Frequently Asked Questions About myequifax.ca

- Conclusion

Common Challenges with myequifax.ca Access

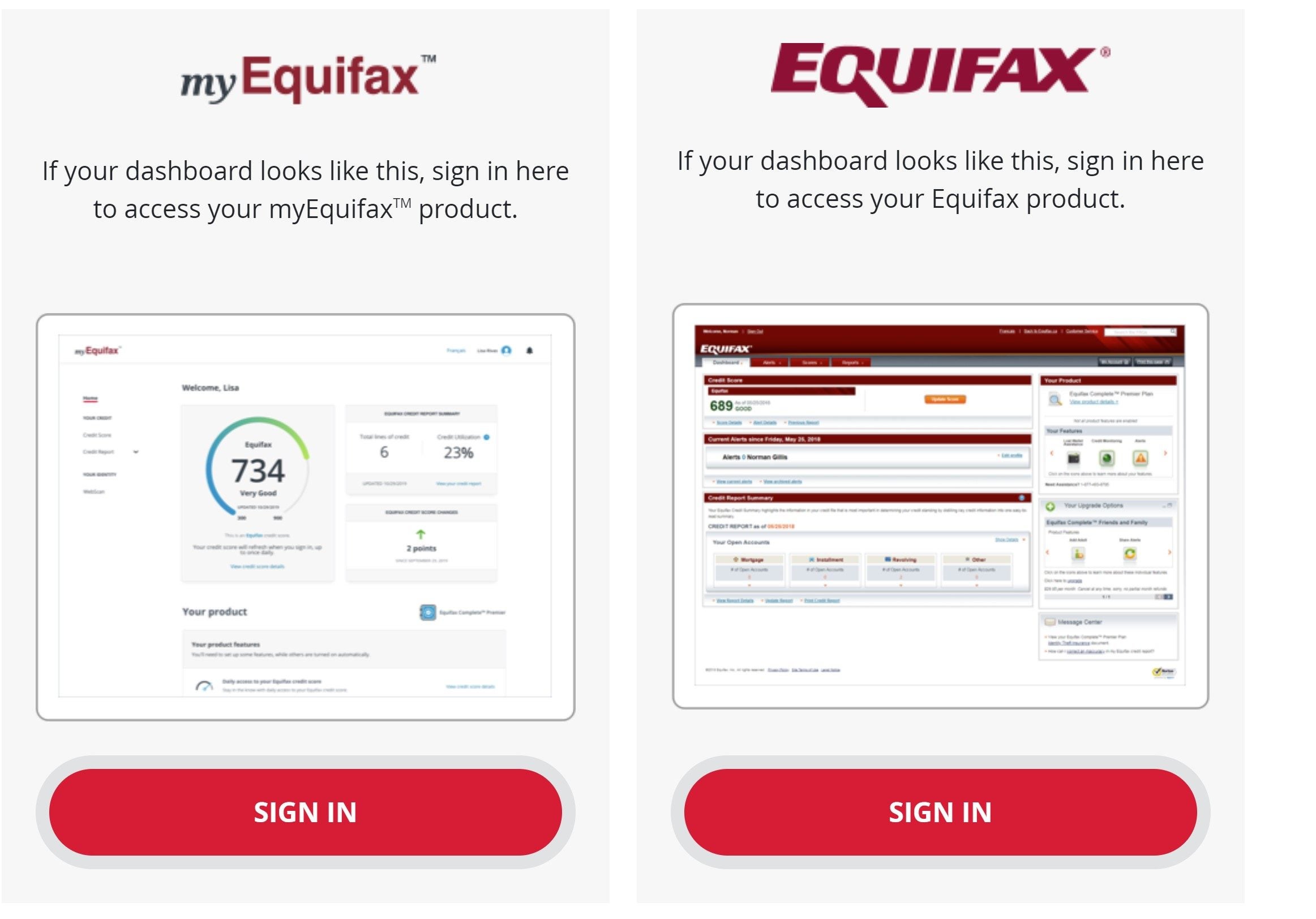

It seems many people are hitting similar walls when trying to use myequifax.ca. These issues range from not being able to sign in, even with the right details, to receiving puzzling messages about their accounts. It's a bit like trying to open a door with the correct key, only to find the lock has changed or the door isn't there anymore. This can be really disheartening, especially when you're just trying to keep tabs on your financial well-being.

Login Troubles and Password Resets

One of the most common complaints revolves around simply getting into the myequifax.ca system. People report having an account, being able to go through the steps to reset their password, but then when they try to use that new password, the system just says the credentials are wrong. It's a very frustrating cycle, you know, because you've done everything right, and yet you're still locked out. This particular problem leaves many feeling quite stumped.

You might try to log in, and the website tells you your email and password combination isn't working. Then, you go through the password reset process, which seems to work fine, but the same problem happens when you try to sign in again. This can lead to a lot of wasted time and growing irritation, as a matter of fact. It really makes you wonder what's happening behind the scenes.

Account Not Found?

Another puzzling situation arises when you try to reset your password or perhaps even create an account, only to be told that Equifax doesn't have an account for you. This happens even when you're using the same email and personal details that you've used before, or that you know are linked to your credit file. It's a bit like being told you don't exist when you clearly do, which is pretty confusing and concerning for anyone trying to manage their credit.

Imagine inputting your name, social security number, and address, expecting to confirm your identity, and then getting a message that no account matches your information. This can be especially alarming if you're certain you've had an account in the past or that Equifax holds your credit data. This particular issue can make you feel quite lost, wondering where your information has gone, or if something is wrong.

System Upgrades and Error Messages

A frequent explanation for these access problems points to Equifax upgrading their systems. While system improvements are generally a good thing, they can, unfortunately, lead to temporary glitches for users trying to access their accounts. You might encounter messages like "myequifax we can't complete your request at this time" or "please give us a call we can't complete." These messages often suggest calling customer care, which can feel like a bit of a runaround when you just want to handle things online.

These upgrade periods can make the website behave in unexpected ways, causing what might seem like random errors. It's not uncommon for a company to have these kinds of issues during a big system change, but for the person trying to use the service, it's still a hurdle. So, it's understandable why people get frustrated when they see these generic error messages popping up repeatedly.

Getting Your Full Credit Picture

Beyond just getting logged in, many users find it challenging to access the full details of their credit report on myequifax.ca. It's one thing to see a brief summary, but quite another to get the deep dive needed for careful review. This is where the "detail beast" in many of us really needs to be fed, you know, with all the specific information.

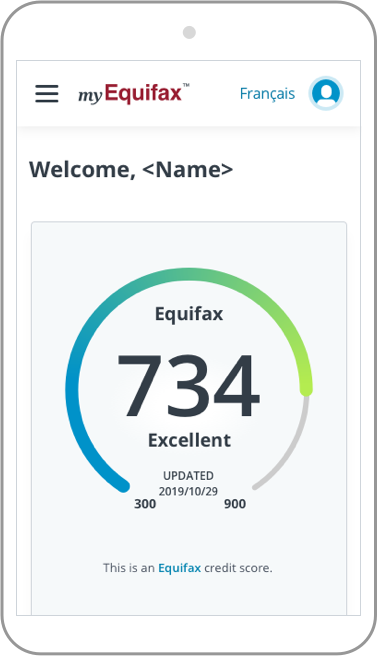

Beyond the Overview: Detailed Reports

While myequifax.ca might offer a nice overview of your credit standing, it often falls short for those who need to see every single detail. People want to see the nitty-gritty, the full list of accounts, payment histories, and all the little bits that make up their complete credit story. Just seeing a summary isn't enough for careful monitoring or when you're trying to figure out why your credit score looks a certain way. This is a very common desire for anyone serious about their finances.

For example, if you're trying to understand why certain aspects of your credit look different, or if you're preparing for a big purchase like a home, that overview just won't cut it. You need to be able to go through each item with a fine-tooth comb. So, it's a bit like getting a book's summary when you really need to read the whole novel to understand the plot fully.

Printing and Downloading Your Report

A significant pain point for users is the lack of clear options to print or download their credit report directly from myequifax.ca. You might search everywhere on the page, and even try looking online for answers, but a print or download button seems to be missing for many. This is a pretty basic function that most online services offer, so its absence can be quite puzzling.

People often need a physical or digital copy of their report for various reasons, whether it's for their own records, to share with a lender, or to review offline. The inability to easily save or print this important document adds another layer of difficulty to managing your credit information. It's just not as straightforward as one might hope, which is rather inconvenient.

Discrepancies and Disputes

It's not uncommon for people to find differences between what one credit monitoring service shows and what appears on their official myequifax.ca report. These discrepancies can be quite concerning, especially when it comes to old accounts or collections. This is where the need for accurate information really becomes clear, and it's something that can cause a lot of worry.

Credit Karma vs. MyEquifax: What's Showing Up?

Many users report that accounts showing on services like Credit Karma don't always line up with what they see on the official myequifax.ca website. For instance, you might have seven old charged-off accounts showing on Credit Karma, but only three appear on your Equifax report. Similarly, a collection might show up on one service but be completely absent from myequifax.ca. This can be very confusing, making it hard to know which information is truly current and complete.

These differences make it tough to get a consistent view of your credit situation. If you're trying to clear up old debts or understand your overall financial picture, these inconsistencies can be a real headache. It begs the question, you know, why are these reports not showing the same information? It's a bit like getting different answers from two different sources about the same thing.

Filing a Dispute Online

Interestingly, some users find that if they go through the motions of filing a dispute on myequifax.ca, they can then see their updated information on their credit report. This suggests that the system might be capable of showing the correct, full data, but perhaps not through the regular viewing channels. It's a roundabout way to get the information you need, but it seems to work for some.

For example, one user noted that after starting a dispute process, their report showed an update from January 8, 2023, suggesting the information was indeed current. However, they still couldn't see the report the "regular" way. This indicates a potential issue with the display or access mechanism rather than the data itself, which is a bit of a relief, but still a problem for regular viewing.

Managing Your Credit File: Freezes and Alerts

Freezing your credit file is a smart move for protecting yourself from identity theft, and many people rely on myequifax.ca for this. However, just like with accessing reports, managing these freezes and alerts can also come with its own set of challenges. It's about having control, and when that control feels shaky, it can be pretty unsettling.

Freezing and Unfreezing Your Equifax File

Users often use myequifax.ca to freeze and unfreeze their Equifax credit file. This is a very important security measure. However, some have reported recent issues with this function. It might have been working fine for a while, and then suddenly, for about a week and a half, they can't get in to manage their freeze. Even changing their password doesn't fix it; they still get the same message telling them to call customer care.

This kind of problem can be quite worrying, especially if you need to unfreeze your credit quickly for a loan application or other financial activity. Not being able to control your credit freeze online when you need to can feel like a real security risk. It's a bit like having the key to your house, but the lock is jammed, so you can't get in or out easily.

Lock & Alert Issues

Similar to freezing, Equifax's Lock & Alert service is designed to give users control over their credit file. Yet, some people have experienced errors when trying to log into this service, or even into myequifax.ca, after a couple of months. These errors prevent them from managing their alerts or locking their file as they intend. This means a very useful security tool becomes less reliable.

If you're relying on Lock & Alert to protect your credit, these access problems can leave you feeling exposed. It's a system that's supposed to give you peace of mind, but when it's not working, it can do the opposite. So, it's pretty clear that these technical glitches have a real impact on people's sense of financial security.

When Online Access Fails: What to Do

Given all these potential hurdles with myequifax.ca, it's helpful to know what steps you can take when online access simply isn't working. Sometimes, despite all your efforts, the digital path just isn't clear, and you need to find another way forward. It's about having a backup plan, you know, for when things don't go as expected.

Contacting Customer Care

Many of the error messages on myequifax.ca direct users to call the customer care team. While this can feel like a last resort after trying to fix things online, it often becomes the only way to get personalized help for complex issues. People report needing to insist on speaking with a supervisor to avoid going "round robin for weeks" with standard support. This suggests that getting to the right person can be a bit of a challenge, but it is often necessary.

When you call, be prepared to explain your issue clearly and patiently. Having specific details about the error messages you received, the steps you've already tried, and the date you last accessed your account can be very helpful. It's a bit like being your own detective, gathering all the clues before you present your case. This approach might yield better results, actually.

Alternative Ways to Get Your Report

If myequifax.ca isn't cooperating, there are other ways to get your credit report. For instance, while annualcreditreport.com is a common resource in the US, some Canadian users have found that for Equifax, it directs them to send a request via mail. This can be a slower process, but it's a reliable way to get a copy of your report if online access is completely blocked.

It's worth exploring all available avenues to ensure you get your credit report, even if it means using a method that takes more time. Your credit report is a very important document, and having a copy is key to monitoring your financial health. So, even if the online path is bumpy, there are other ways to reach your destination.

Equifax's Ongoing Efforts

It seems clear that Equifax has some ongoing work to do to improve the myequifax.ca website experience. The frequent reports of login problems, missing features like print/download options, and discrepancies between reports suggest a need for more stable and user-friendly online services. Companies often work on making their digital platforms better, and this seems to be a current focus for Equifax.

When a company is undergoing system upgrades, it's often with the goal of making things run more smoothly in the long run. The current challenges, while frustrating for users, are hopefully part of a process that will lead to a more reliable and complete myequifax.ca experience in the future. It's a bit like renovating a house; things might be messy during the work, but the hope is for a much better home when it's all done.

Frequently Asked Questions About myequifax.ca

Here are some common questions people have when dealing with myequifax.ca, based on frequent user experiences:

1. Why can't I log into my myequifax.ca account even after resetting my password?

This is a very common issue. Many users report being able to successfully reset their password, but then they still can't log in, getting a message that their credentials are wrong. This might be due to ongoing system upgrades or a glitch in how the new password is being recognized. Often, the website will suggest calling customer care to address this specific problem.

2. Why do some accounts show on Credit Karma but not on my official myequifax.ca report?

Discrepancies between different credit monitoring services and your official myequifax.ca report can happen. This might be due to different reporting cycles, or perhaps the way certain older or charged-off accounts are displayed. Sometimes, initiating a dispute on myequifax.ca can reveal more updated or complete information, even if you can't see it through regular viewing.

3. How can I get a detailed, printable copy of my credit report from myequifax.ca?

Many users find it difficult to locate a print or download option for their full credit report on myequifax.ca. While the site might offer an overview, getting a detailed, savable copy can be a challenge. If direct online access for printing isn't working, you might need to contact Equifax customer care or explore alternative methods for requesting your report, such as via mail, if that option is available in your region.

Conclusion

Dealing with myequifax.ca can, at times, feel like a bit of a test of patience, especially when you're facing login issues, account discrepancies, or problems getting a full view of your credit report. It's clear that many people share these experiences, from the frustration of a password reset that doesn't quite work to the puzzling differences between credit reports from different sources. The ongoing system upgrades at Equifax, while aiming for better service, do seem to cause some temporary hiccups for users trying to access their important financial information.

Despite these challenges, staying on top of your credit health is very important. If you find yourself hitting a wall with myequifax.ca, remember that persistence and exploring alternative methods are key. Whether it means reaching out to customer care, being ready to provide all the details of your issue, or considering other ways to get your credit report, there are paths forward. Your credit report is a vital document for your financial life, and regaining access to it is worth the effort. Learn more about credit monitoring on our site, and perhaps you'll find other helpful resources here on this page about common access issues.

Detail Author:

- Name : Dr. Aidan Frami I

- Username : ysatterfield

- Email : hilpert.katelyn@yahoo.com

- Birthdate : 1991-03-24

- Address : 80562 Bernier Rapid Bernhardland, NC 92889-8932

- Phone : (930) 770-3220

- Company : Kerluke LLC

- Job : Director Of Marketing

- Bio : Aut repellat repellendus dolore corrupti quisquam ut ut. Ut cumque voluptatum aut dolorem dolorem. Nam ea unde exercitationem temporibus.

Socials

linkedin:

- url : https://linkedin.com/in/jenkinsa

- username : jenkinsa

- bio : Ut expedita ea consequatur sunt dolorum.

- followers : 5255

- following : 2651

instagram:

- url : https://instagram.com/jenkinsa

- username : jenkinsa

- bio : Officiis enim rerum quam autem. Suscipit mollitia nam dicta non.

- followers : 272

- following : 2180

facebook:

- url : https://facebook.com/amelie_xx

- username : amelie_xx

- bio : Minus non id qui nulla. Nobis occaecati sunt dolorum placeat dolor non debitis.

- followers : 6333

- following : 2708