Taking care of your credit accounts can sometimes feel like a lot to handle, can't it? For folks who have credit cards from Comenity Bank, finding a simple way to manage those accounts is really quite important. That's where something like the Comenity Easy Pay app comes into play, offering a handy way to keep track of your money matters right from your phone. It's almost like having a little helper in your pocket for all your payment needs.

You know, for someone who has several Comenity cards, like an IKEA Projekt card, an AAA Visa, or even a Bread Cashback card, it can get a bit much trying to sign into each one separately. I mean, it's a bit of a pain, isn't it? This app, so it seems, aims to make things a little less complicated, bringing a good deal of your account info together in one spot.

It's all about making your daily money tasks simpler, really. Think about those times you need to check your balance, or maybe you just got paid and want to send a payment right away. The Comenity Easy Pay app, arguably, tries to make those actions quick and easy, giving you more time for other things. It's a pretty useful tool for staying on top of your financial picture.

Table of Contents

- Understanding the Comenity Easy Pay App

- Making Payments Simple and Safe

- Managing Multiple Comenity Accounts

- Troubleshooting and Support

- Common Questions About the App

- The Future of Your Comenity Experience

Understanding the Comenity Easy Pay App

When you're dealing with credit cards, especially from a company like Comenity, having a clear way to manage them is pretty important. The Comenity Easy Pay app, in a way, aims to be that clear path. It's built to help you handle your accounts without too much fuss, right from your mobile device. So, it's kind of like a personal account manager in your pocket, really.

Many folks, myself included, have a few cards from Comenity. I mean, I currently have six Comenity cards, which include my IKEA Projekt card and others like my AAA Visa. Keeping up with each one individually can be a bit of a chore. This app, you know, is supposed to bring all that together, making it simpler to see what's going on with your money.

The idea behind it is to give you control. You can check balances, see recent activities, and, most importantly, make payments. It's a pretty direct approach to managing your credit, which is something many people appreciate these days. So, it's not just about paying, it's about staying informed about your spending and your account health.

What It Does For You

The Comenity Easy Pay app, supposedly, puts a good deal of your account details right at your fingertips. You can, for instance, look at your current balance without having to log into a computer. This is quite helpful if you're out and about and just want a quick check on your spending limits or how much you owe.

It also lets you see your transaction history. This is pretty useful for keeping an eye on where your money is going. You can spot charges you don't recognize, which is a good thing for safety. I mean, I once had someone steal my identity and apply for a Sephora card three times, so seeing those transactions quickly would have been a big help, you know?

Beyond just looking at things, the app typically lets you set up payment reminders. This can be a real lifesaver if you're busy and sometimes forget due dates. Getting a little nudge can help you avoid late payments, which is something everyone wants to do, right? A single late payment, even on something like an Overstock card, can be a real headache to get removed.

Getting Started with the App

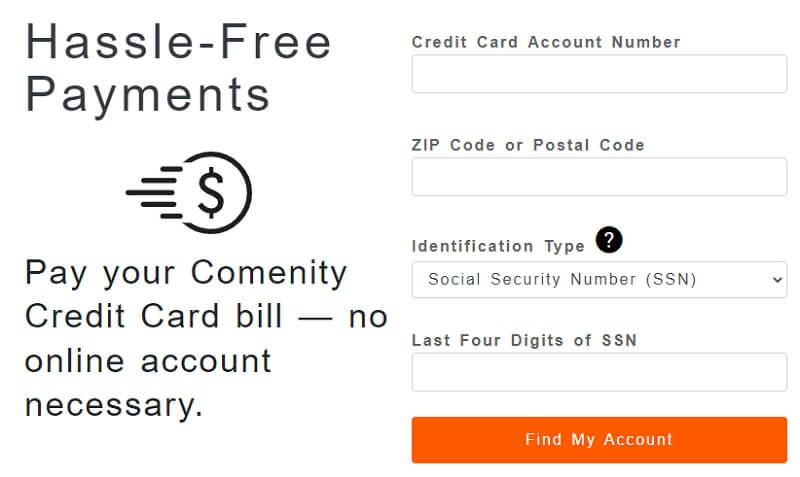

Getting the Comenity Easy Pay app onto your phone is usually pretty straightforward. You'd typically find it in your phone's app store, just like any other application. Once you download it, you'll need to sign in with your Comenity account details. If you don't have an online account yet, you might need to set one up first, which is pretty common for these kinds of apps.

After you're logged in, the app will, more or less, show you your linked Comenity accounts. This is where it gets handy, especially if you have several cards. You can then pick which account you want to look at or pay. It's designed to be a pretty simple process, so you can get to what you need without too much searching around.

Setting up your payment methods within the app is another step. You'll likely link your bank account so you can send money directly from there. This is a common practice for mobile payment apps, and it makes paying your bills pretty quick once it's all set up. So, it's all about getting your ducks in a row for easy future payments.

Making Payments Simple and Safe

The main reason many people get the Comenity Easy Pay app is, well, to make payments. It's supposed to take the hassle out of sending money to your credit card company. When you can just tap a few buttons on your phone and get it done, it really does make things feel a lot simpler, doesn't it? It's a pretty big step up from mailing checks, for sure.

But it's not just about ease; it's also about feeling safe when you're moving your money around. Mobile apps, especially those dealing with finances, have to be pretty careful with your information. The app, presumably, has ways to keep your personal and banking details private. That's a pretty important thing for anyone using it.

Think about how often you use your phone for other things. Checking email, looking up directions, talking to friends. Adding bill paying to that list, especially when it's made simple, just makes sense for a lot of people. It's a pretty modern way to handle your money, and it fits right into our busy lives.

Paying Your Bills with Ease

Sending a payment through the Comenity Easy Pay app is, generally speaking, quite straightforward. Once you're logged in and have your bank account linked, you can usually see your minimum payment due and your total balance. You then choose how much you want to pay, and when you want to send it. It's a pretty clear process, which is good.

You can often set up one-time payments or schedule payments for a future date. This is really handy if you want to pay your bill as soon as you get paid, but your due date isn't for another week. You can just set it and forget it, more or less. This helps avoid those last-minute rushes and potential late fees, which is a big plus.

The app typically confirms your payment once it's sent, giving you peace of mind. You'll usually get a confirmation number or an email, so you have a record. This kind of confirmation is pretty important, especially if you ever need to prove you made a payment. It's all about making sure you feel secure in your actions.

Keeping Your Account Secure

When it comes to your money, security is, arguably, one of the most important things. The Comenity Easy Pay app, like most financial apps, uses various security measures to protect your information. This usually includes things like encryption, which scrambles your data so others can't easily read it. It's a pretty standard practice for keeping things safe online.

You might also find features like fingerprint login or facial recognition, depending on your phone. These extra layers of protection make it harder for someone else to get into your account, even if they somehow got your password. It's a pretty smart way to keep your money safe, really.

However, it's still good to be careful. I mean, last week I had applied for five Comenity Bank store cards and was instantly approved. I was excited, but it was short-lived. Today, I logged in to find someone stole my identity and applied for a Sephora card three times. Even with good security, keeping an eye on your account activity is pretty important. If something seems off, checking your account through the app or calling Comenity (Bread) right away is a good idea. They might say they have no record of the pulls, but it's still good to alert them.

Managing Multiple Comenity Accounts

Having several credit cards can be a bit of a juggling act, can't it? Especially when they're all from the same bank, like Comenity. I currently have an account with Comenity for the IKEA Projekt card, and I was approved for 5k instantly, which came just a couple days after a 7k instant approval. So, it didn't seem odd to me when I received an email from Comenity Bank about a fraud flag last week. When you have so many, keeping them all straight is pretty important.

The Comenity Easy Pay app, in theory, should help with this. The idea is that you can see and manage all your Comenity cards from one place, rather than having to sign into multiple Comenity accounts separately. This can be a real time-saver and make managing your money a lot less frustrating. It's kind of like having a central hub for all your Comenity dealings.

However, as @g2244 wrote, @masscredit bread/Comenity is more than a bit of a pain in this sense. Basically, each account (card) has its own login, which can be a bit of a hassle. So, while the app aims to bring things together, you might still find yourself dealing with separate logins for different cards. It's something to keep in mind when you're setting things up.

A Single Spot for Your Cards?

The promise of a single app to manage all your Comenity cards is pretty appealing. Imagine just opening one app and seeing your IKEA card, your AAA Visa, and your Bread Cashback card all listed there. This would, arguably, make it much simpler to check balances, see recent purchases, and make payments for each one.

However, the reality for some might be a little different. As mentioned, Comenity is much like Synchrony in that each card often has its own online portal. So, while the app might be a general "Comenity" app, you might still need to switch between different card accounts within it, or even have separate logins for each one. It's a bit of a nuance to how they set things up.

This means that while the app is a helpful tool, it might not completely eliminate the need to remember different login details or navigate between different card sections. It's something to be aware of, so you don't get surprised when you first start using it. It's still a step towards making things easier, but maybe not a complete one-stop shop for absolutely everything.

Dealing with Account Changes

Credit card accounts can change over time, and it's pretty important to stay updated. For instance, I received a letter today that my Comenity Mastercard is changing to a Bread Rewards Amex card in September. The rewards are also changing. These kinds of updates can affect how you manage your card, and the app, in theory, should help you keep track of these things.

When your card details or terms change, you'll want to check if the app reflects these updates. Sometimes, you might get a notification within the app, or you'll see the new card type listed. It's a pretty good way to stay informed without having to dig through paper mail. This kind of quick update can be very useful for managing your money effectively.

If you have questions about a change, like new rewards or a different card type, the app might have a way to connect you to customer service. Or, you might need to call them directly. It's always a good idea to clarify any changes that affect your spending or payment habits. Being proactive is, generally, a smart move with credit cards.

Troubleshooting and Support

Even with the best apps, sometimes things don't go exactly as planned, do they? Maybe a payment doesn't seem to go through, or you can't log in. When you're dealing with your money, these little bumps can feel like a pretty big deal. So, knowing what to do when you hit a snag with the Comenity Easy Pay app is quite important.

It's like any piece of technology, really. Sometimes it works perfectly, and sometimes it needs a little nudge. The good news is that most apps, including financial ones, usually have ways to help you out. It's all about finding the right path to get your issue sorted so you can get back to managing your accounts without stress.

Having a plan for when things go wrong can save you a lot of frustration. Knowing who to call or where to look for answers can make a big difference. It's a pretty practical approach to using any app, especially one that handles your financial information. So, let's look at some common issues and how to get help.

When Things Don't Go as Planned

One common issue could be a payment that doesn't show up right away. You might send money through the app, and then you check your account, and it still shows the old balance. This can be pretty worrying, can't it? Usually, payments take a day or two to process, so a little patience is often needed. But if it takes too long, that's when you need to act.

Another thing that can happen is trouble logging in. Maybe your password isn't working, or the app is just being a bit slow. Sometimes, just closing the app and opening it again, or even restarting your phone, can fix these little glitches. It's a pretty simple trick that often works wonders for apps that are acting up.

Then there are bigger issues, like seeing charges you didn't make, or not being able to access your account at all. This is when you really need to get in touch with Comenity directly. I mean, I called Comenity (Bread) when someone stole my identity and applied for a Sephora card, and they said they had no record of the pulls. So, sometimes, you have to be persistent to get things sorted out.

Getting Help When You Need It

If you run into a problem with the Comenity Easy Pay app, the first place to look is often the app itself. Many apps have a "help" or "support" section that can answer common questions. You might find a frequently asked questions area or even a way to send a message to their support team directly from the app. It's a pretty convenient starting point.

If the app's help section doesn't do the trick, then calling Comenity Bank's customer service is usually the next step. They can look into your specific account and see what's going on. Having your account number ready and being clear about the issue will help them help you faster. It's all about giving them the right information, you know?

For something like getting a late mark removed, especially if it's just one late payment through Overstock, you'll definitely want to talk to a person. Has anyone had success or trouble getting a late mark removed with Comenity? It's often a conversation that needs to happen directly with them. They might be able to help, or they might not, but it's worth the call to try and sort it out. You can learn more about consumer financial rights on other sites.

Common Questions About the App

People often have similar questions when they start using a new financial app, and the Comenity Easy Pay app is no different. It's pretty normal to wonder about how it works, what you can do, and if it's safe. So, let's go over a few common things people ask about this app, which might help you feel a bit more comfortable using it.

Knowing the answers to these common questions can save you time and make your experience smoother. It's like having a little guide before you even start. So, here are some of the things people often ask, and hopefully, the answers will clear things up for you.

These questions often come up in places like "People Also Ask" sections on search engines, so addressing them here can be pretty helpful. It's all about giving you the information you need, when you need it, to manage your Comenity accounts with more ease.

Is there a Comenity Bank app?

Yes, there is, actually. The Comenity Easy Pay app is, in essence, the mobile application that Comenity Bank provides for its credit cardholders. It's designed to give you a way to manage your accounts on the go, without needing to use a computer. So, if you're looking for a Comenity app, this is typically the one you'd be looking for.

It's available for both Apple and Android devices, so most smartphone users should be able to download it. You just head to your phone's app store, search for "Comenity Easy Pay," and you should find it there. It's a pretty standard way to get financial apps these days, you know?

This app is meant to be your primary mobile access point for your Comenity accounts. So, yes, if you're wondering if there's an official app, this is it. It's how they've made it easier for people to handle their credit cards from their phones.

How do I make a payment on Comenity?

Making a payment on your Comenity card is, generally speaking, quite simple through the Comenity Easy Pay app. Once you've logged in, you'll usually see an option like "Make a Payment" or "Pay Bill." You just tap on that, and it guides you through the steps. It's a pretty intuitive process, really.

You'll typically choose the amount you want to pay, like your minimum due or your full balance. Then you pick the date you want the payment to go through and select your linked bank account. After reviewing the details, you confirm the payment, and it's sent. It's all pretty straightforward, honestly.

Besides the app, you can also make payments directly on the Comenity Bank website, or by calling their customer service number. Some people still prefer to mail a check, too. But for speed and convenience, the app is a pretty popular choice for many folks these days. Learn more about online payment options on our site, and link to this page payment methods explained.

Can I pay my Comenity card with a debit card?

This is a common question, and generally, most credit card companies, including Comenity, prefer payments directly from a bank account. While some companies might allow debit card payments over the phone or in specific situations, it's not always the primary or easiest way to pay through an app. It's something that varies, so it's good to check.

Typically, when you set up payments in the Comenity Easy Pay app, you'll link your checking or savings account using your bank's routing and account numbers. This is the most common and usually fee-free method for sending money to your credit card. It's a pretty standard way to handle bill payments online.

If you're really set on using a debit card, you might need to call Comenity customer service directly to see if that's an option for your specific card or if there are any fees involved. It's always best to confirm with them directly, as policies can sometimes change. So, while bank transfers are usually the way to go, it's worth asking if you have a different preference.

The Future of Your Comenity Experience

As you can see, the Comenity Easy Pay app is designed to make managing your Comenity credit cards a good deal simpler. From checking your balance to making payments, it puts a lot of control right in your hand. For someone with several Comenity cards, like my six Comenity cards including the AAA Visa and Bread Cashback, having a tool like this is pretty useful for keeping everything organized.

It's all about making your financial life a bit smoother, really. Being able to quickly check on things, especially after something like an instant approval for 5k or 7k, gives you peace of mind. And if something seems off, like a fraud flag or an unexpected application, having quick access to your account details is pretty important.

So, if you have Comenity credit cards, exploring the Comenity Easy Pay app is definitely something to consider. It's a pretty handy way to stay on top of your accounts, make payments, and keep an eye on your financial health, all from your phone. It's all about taking charge of your money in a simple, modern way.

Detail Author:

- Name : Nicholaus Mueller

- Username : shanel.mccullough

- Email : ruby.rodriguez@gmail.com

- Birthdate : 1983-04-16

- Address : 488 Pagac Common Jalonport, SC 83123-3969

- Phone : (484) 782-4579

- Company : Runolfsdottir, Dare and Conroy

- Job : Roustabouts

- Bio : Corrupti blanditiis animi et nihil odit. Libero quia nesciunt dignissimos voluptatem et nihil. Quo nesciunt molestiae vel. Nihil rem quis consequatur ut aliquam provident.

Socials

facebook:

- url : https://facebook.com/donald_o'hara

- username : donald_o'hara

- bio : Quo qui quis ut necessitatibus repellat quia.

- followers : 979

- following : 2905

tiktok:

- url : https://tiktok.com/@donald.o'hara

- username : donald.o'hara

- bio : Consequuntur quo quia suscipit rerum. Labore animi dolor quas aliquid nihil.

- followers : 5955

- following : 1429

linkedin:

- url : https://linkedin.com/in/do'hara

- username : do'hara

- bio : Nihil et aliquid consequuntur quo et.

- followers : 934

- following : 35

instagram:

- url : https://instagram.com/donald_xx

- username : donald_xx

- bio : Cum error alias quo atque assumenda dolorum. Autem reprehenderit similique ut quibusdam ea et.

- followers : 3821

- following : 622