Are you a frequent shopper at Fleet Farm, perhaps always looking for ways to make your purchases stretch a little further? Many folks who visit these stores, whether for outdoor gear, farming supplies, or home goods, often wonder if there's a special way to save. Well, there very much could be, and it often involves a store-specific payment option.

For those who spend a good bit of time at Fleet Farm, picking up items for the garden, the workshop, or just everyday living, a dedicated payment method might seem like a natural next step. You might be curious about what advantages such a card brings, or if it truly helps you get more value from your shopping trips. It’s a fair question, really, as these sorts of cards are designed to reward loyal customers.

This piece will explore the Fleet Farm credit card, looking at what it offers and how it works. We’ll talk about who might find it most useful, the sorts of benefits you could see, and some important things to think about before you decide to apply. We'll also cover the application process and how to manage your account once you have it. Just so you know, the "My text" information you shared about JetBrains Fleet IDE is not related to Fleet Farm or its credit card, so we won't be using that for this discussion.

Table of Contents

- What is the Fleet Farm Credit Card?

- Who Might Find This Card Useful?

- The Perks of Carrying a Fleet Farm Card

- Things to Consider Before You Apply

- How to Get Your Own Fleet Farm Credit Card

- Managing Your Fleet Farm Credit Account

- Is the Fleet Farm Credit Card Right for You?

- Looking Ahead: What to Expect

- Frequently Asked Questions About the Fleet Farm Credit Card

What is the Fleet Farm Credit Card?

The Fleet Farm credit card is a store-branded payment tool, issued by a bank that partners with Fleet Farm. It’s pretty much designed to give special benefits to people who shop regularly at their stores. Think of it as a way for Fleet Farm to say "thank you" to its most dedicated customers, and to encourage them to keep coming back, you know?

This type of card, typically a private label card, usually works only at Fleet Farm locations and on their website. It’s not like a general-purpose card you can use anywhere Visa or Mastercard is accepted. That’s a key difference, so, it’s important to remember that particular detail when you consider getting one.

The main idea behind having a Fleet Farm credit card is to provide cardholders with a path to savings and special offers that regular shoppers might not get. These can include things like discounts on purchases, special financing plans for bigger buys, or even a system where you earn points for every dollar spent. It’s all about adding extra value to your shopping trips, really.

Who Might Find This Card Useful?

Someone who shops at Fleet Farm quite often, perhaps on a weekly or monthly basis, could find this card to be a good fit. If you're always picking up feed, tools, fishing gear, or even just household items there, the benefits might add up nicely. It’s almost like the card is made for people who consider Fleet Farm a regular stop for their supplies, you know?

It's also a consideration for those planning a large purchase, such as a new lawn tractor or a big order of fencing materials. Special financing offers, which we'll talk about a bit more, could make these bigger buys more manageable over time. So, if you've got a significant project coming up that involves Fleet Farm products, this card might be worth a look.

On the other hand, if you only visit Fleet Farm once or twice a year, the card might not offer enough value to make it worthwhile. The benefits are usually best for those with a consistent shopping habit at the store. You really need to weigh how often you actually spend money there, that’s the thing.

The Perks of Carrying a Fleet Farm Card

Having a Fleet Farm credit card often comes with a few neat advantages designed to sweeten the deal for shoppers. These benefits are usually the main reason people consider getting one. They are, in a way, a little thank you from the store for your loyalty, and that’s pretty cool.

Exclusive Savings and Discounts

One of the biggest draws is access to special discounts that are only for cardholders. This could mean a percentage off your first purchase when you open the account, or perhaps special sale prices on certain items throughout the year. These kinds of savings can really make a difference, especially on larger purchases, so it's something to think about.

Sometimes, you might get a birthday discount or a special coupon book sent to you just for being a cardholder. These little extras can add up over time, making your shopping trips a bit more budget-friendly. It’s a bit like getting a secret handshake into a club where everything costs a little less, arguably.

Special Financing Options

For bigger-ticket items, the Fleet Farm credit card might offer special financing plans. This often means you can pay for a large purchase over several months without paying any interest, as long as you pay the full amount by the end of the promotional period. This can be a huge help for managing your budget, particularly for things like appliances or power tools.

However, it’s really important to read the fine print on these offers. If you don't pay off the full amount before the promotional period ends, you might be charged interest from the original purchase date, which can be quite a bit. So, you know, always be sure you can meet those payment deadlines.

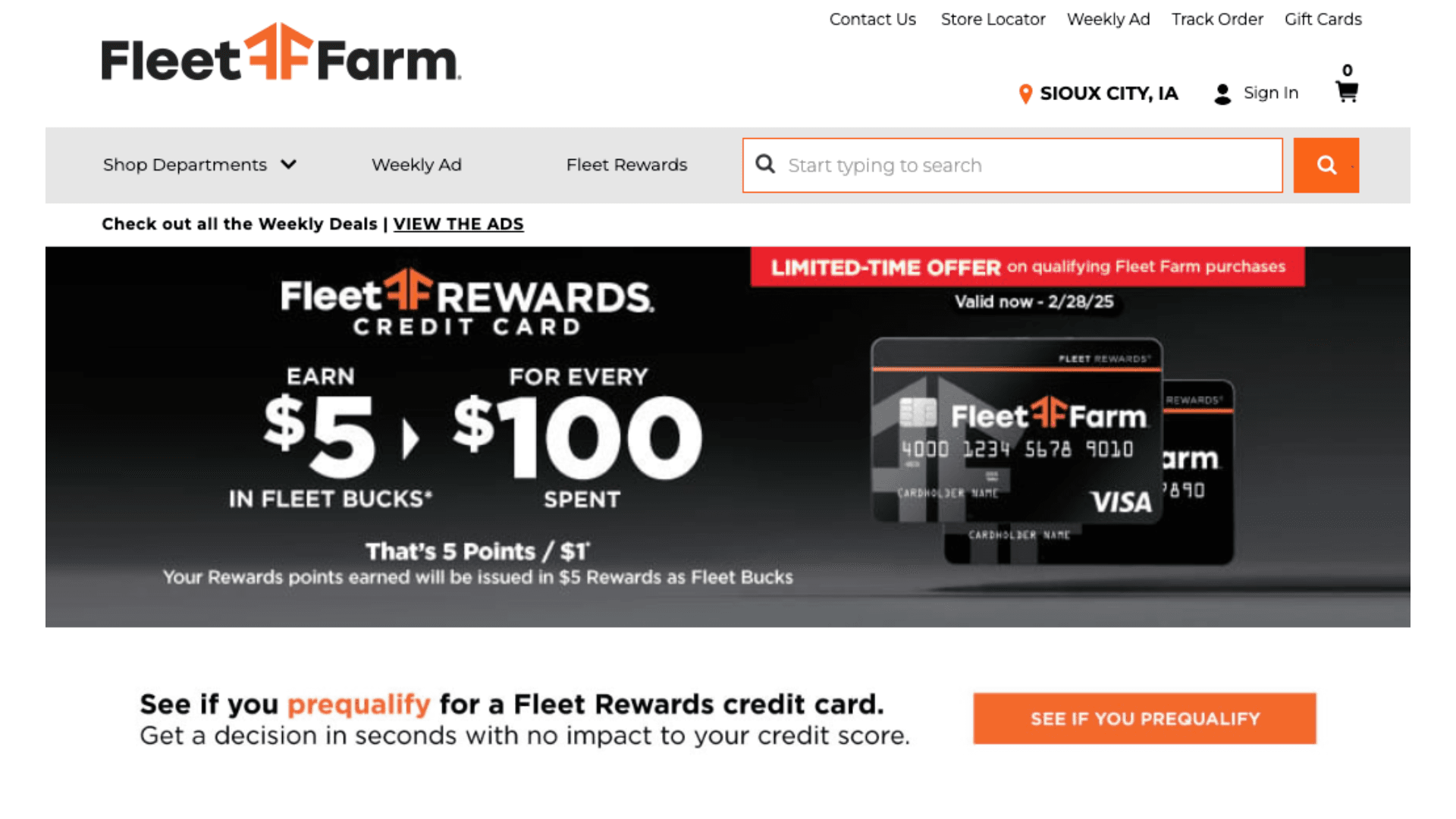

Rewards and Loyalty Programs

Many store cards, including the Fleet Farm credit card, come with some sort of rewards program. This means you earn points for every dollar you spend at Fleet Farm. Once you collect enough points, you can usually redeem them for discounts on future purchases or other store benefits. It’s a straightforward way to get a little something back, basically.

The exact value of these rewards can vary, so it’s a good idea to understand how the points convert into savings. Some programs might offer a higher earning rate during special promotions, giving you a chance to rack up points faster. It’s a pretty common perk, and you often see it with these types of cards.

Things to Consider Before You Apply

Before you jump into applying for any credit card, including the Fleet Farm credit card, it’s a good idea to pause and think about a few important aspects. Making an informed choice can save you from unexpected surprises down the road, and that’s a sensible approach, you know.

Understanding the Annual Percentage Rate (APR)

Store credit cards often come with a higher Annual Percentage Rate (APR) compared to general-purpose credit cards. This means if you carry a balance from month to month, the interest charges can add up very quickly. It's a pretty big deal if you don't pay your bill in full each time.

So, if you plan to use the card and pay off your balance in full every month, the APR might not be a major concern. But if you think you might carry a balance, it's something you really need to consider. That high interest rate could easily outweigh any savings you get from discounts or rewards, after all.

Where You Can Use It

As mentioned earlier, the Fleet Farm credit card is generally a "closed-loop" card, meaning you can only use it at Fleet Farm stores and on their official website. This is different from a general-purpose card that you can use almost anywhere. It’s a very specific tool for a very specific place.

This limited usability means it won't help you with purchases at other retailers or for everyday expenses like gas or groceries. So, you should think about whether a card with such limited use fits into your overall spending habits. It's not a general solution for all your shopping needs, so keep that in mind.

Impact on Your Credit Standing

Like any credit card, opening a Fleet Farm credit card account will show up on your credit report. If you manage the account responsibly, making payments on time and keeping your balances low, it can actually help build your credit history. This can be a good thing for your overall financial health, as a matter of fact.

However, if you miss payments or run up a high balance, it could negatively affect your credit score. This is true for any credit card, but it's worth remembering for store cards too. It's a bit of a double-edged sword, you know, so responsible use is pretty important.

How to Get Your Own Fleet Farm Credit Card

If you've decided that the Fleet Farm credit card might be a good fit for your shopping habits, the next step is to understand how to apply. The process is pretty similar to applying for other types of credit, though there are a few things to keep in mind, obviously.

Checking Eligibility

To be approved for the Fleet Farm credit card, you'll need to meet certain eligibility requirements set by the issuing bank. This usually includes being at least 18 years old and having a valid Social Security number. They will also look at your credit history, so a reasonably good credit score is usually helpful for approval, too.

If you have a limited credit history or a lower credit score, approval might be more challenging. It’s always a good idea to check your credit report beforehand to make sure there are no surprises. This way, you have a better idea of your chances before you even start the application, which is a smart move.

The Application Process

You can typically apply for the Fleet Farm credit card either in person at a Fleet Farm store or online through their website. The online application is often quick and convenient, allowing you to complete it from the comfort of your home. You'll need to provide personal details like your name, address, income information, and your Social Security number, naturally.

When applying in the store, a customer service associate can guide you through the process and answer any questions you might have right there. Some people prefer this personal touch, as it can feel a bit more straightforward. Either way, the information you provide will be used to check your creditworthiness, basically.

What Happens After Applying

Once you submit your application, the bank will review your information and credit history. Sometimes, you might get an instant decision, especially if you apply online. Other times, it might take a few business days to hear back. This waiting period is pretty normal for credit card applications, you know.

If approved, your new Fleet Farm credit card will be mailed to you, usually within a week or two. You might also receive a temporary account number or a way to make your first purchase right away if you applied in-store. It’s a pretty exciting moment when that card finally arrives, you know?

Managing Your Fleet Farm Credit Account

Once you have your Fleet Farm credit card, managing it responsibly is key to getting the most out of it and keeping your credit in good shape. It’s not just about spending; it’s about handling your payments and keeping an eye on your statements, too.

Making Payments

You’ll receive a monthly statement outlining your purchases, the amount due, and the payment due date. It’s really important to pay at least the minimum amount by the due date to avoid late fees and negative marks on your credit report. Paying the full balance each month is even better, as it helps you avoid interest charges, obviously.

Most credit card issuers offer several ways to make payments, including online through their website, by mail, or sometimes even in person at the store. Setting up automatic payments can be a convenient way to ensure you never miss a due date. It’s a smart move for staying on top of things, essentially.

Keeping Track of Your Statements

Regularly reviewing your monthly statements is a good habit. This allows you to check for any unauthorized transactions and keep track of your spending. It also helps you see how much interest you might be paying if you carry a balance. Being aware of these details is pretty important, you know?

Many card issuers provide online access to your statements, so you can check them anytime. This digital access makes it easier to monitor your account activity and plan your budget. It’s a very handy feature for staying organized, as a matter of fact.

Getting Help with Your Card

If you have questions about your Fleet Farm credit card, or if you run into any issues, you can usually contact the card issuer's customer service. Their contact information will typically be on the back of your card or on your monthly statement. Don’t hesitate to reach out if you need assistance, that’s what they are there for.

They can help with things like understanding your bill, reporting a lost or stolen card, or resolving any disputes about charges. Getting help quickly can prevent small issues from becoming bigger problems. So, if something seems off, it's a good idea to call them right away.

Is the Fleet Farm Credit Card Right for You?

Deciding whether the Fleet Farm credit card is a good fit really comes down to your personal shopping habits and financial goals. If you're a loyal Fleet Farm customer who consistently makes purchases there, the discounts and rewards could offer some genuine value. It's a bit like getting a bonus for doing what you already do, in a way.

However, if you rarely shop at Fleet Farm, or if you tend to carry balances on your credit cards, the potential high APR might make it less appealing. It's important to consider if the benefits outweigh the possible costs, especially the interest. You really need to be honest with yourself about how you manage credit, too.

Before applying, it might be helpful to visit the official Fleet Farm website or the credit card issuer's site to get the most current information on rates, terms, and benefits. Information can change, so having the latest details is always a good idea. You can learn more about credit card options on our site, and also check out this page for more financial tips.

Consider checking Google Trends for "fleet farm credit card" to see how interest in this card changes over time, especially around seasonal sales. This can give you a sense of when others are also looking into it, and perhaps when the best promotions might pop up. It’s a good way to stay informed, you know.

Looking Ahead: What to Expect

The world of retail credit cards, including the Fleet Farm credit card, often sees updates to their programs and benefits. As of early 2024, the general structure of store cards remains pretty consistent: offering specific perks for loyalty. Keep an eye out for any announcements from Fleet Farm or their credit card partner regarding new features or changes to the rewards system. Things like that happen, so it's good to be aware.

The goal for any cardholder should always be to use the card wisely, taking full advantage of the benefits without falling into the trap of high-interest debt. It’s a tool, like any other, and its usefulness really depends on how you wield it. Being a smart shopper means being a smart card user, too, basically.

Frequently Asked Questions About the Fleet Farm Credit Card

Here are some common questions people often ask about the Fleet Farm credit card:

Is the Fleet Farm credit card worth it?

The value of the Fleet Farm credit card really depends on how often you shop at Fleet Farm and your ability to pay off your balance each month. If you are a frequent shopper and can avoid interest charges, the exclusive discounts and rewards can make it quite worthwhile. Otherwise, it might not be the best fit for you, honestly.

What are the benefits

Detail Author:

- Name : Leanna Hettinger

- Username : haley.rasheed

- Email : rauer@hotmail.com

- Birthdate : 1994-05-18

- Address : 56110 Feeney Estate Apt. 515 Rennerview, LA 12347

- Phone : 435.805.8321

- Company : Lebsack-Wisozk

- Job : Nuclear Technician

- Bio : Exercitationem et velit et quam culpa id. Sed hic at ipsum odit. Eaque officia maxime ut laborum sit iusto.

Socials

facebook:

- url : https://facebook.com/zemlak2012

- username : zemlak2012

- bio : Commodi hic et nemo molestias. Temporibus ut explicabo voluptate rerum.

- followers : 867

- following : 1755

twitter:

- url : https://twitter.com/camren_official

- username : camren_official

- bio : Qui dolorem labore adipisci sint nostrum. Totam inventore itaque ipsam voluptatem quis. Eum consequatur illum qui voluptate in.

- followers : 4370

- following : 2180