When a famous person passes away, folks often wonder about their money and who gets what. It's a natural thing, really, to be curious about how someone's belongings are shared after they're gone. For Burt Reynolds, a much-loved actor with a huge presence on screen, his final arrangements brought up a lot of questions. Many people were quite surprised, you know, by some of the choices he made regarding his estate.

The question that kept popping up, and still does, is "Why did Burt Reynolds leave his son out of his will?" This particular detail caught many by surprise, considering his son, Quinton, was his only child. It makes you think, doesn't it, about the personal reasons behind such a significant decision.

Understanding the full picture means looking beyond just the headlines. We need to consider Burt's life, his financial path, and the kind of relationship he had with his son. It's a rather complex story, and as a matter of fact, it offers a glimpse into the private world of a public figure.

Table of Contents

- Burt Reynolds: A Glimpse at a Legendary Life

- Personal Details and Biography

- The Will's Contents: What It Said

- Understanding the Trust for Quinton

- Reasons Behind the Decision

- The Son's Perspective and Public Reaction

- The Broader Picture: Celebrity Estates and Planning

- What We Can Learn from This Story

Burt Reynolds: A Glimpse at a Legendary Life

Burt Reynolds, a name that just about everyone recognized, lived a life full of bright lights and big screen moments. He was known for his charm, his memorable roles, and a smile that could light up a room. From "Smokey and the Bandit" to "Boogie Nights," he gave us so many characters to enjoy. His career, you see, spanned many decades, bringing him both immense fame and, at times, significant financial struggles.

He was, in a way, a true Hollywood icon, a man who seemed larger than life. His journey wasn't always smooth, however. There were periods of great success and, then again, moments of considerable difficulty. These ups and downs, in fact, shaped his life in ways many of us might not fully grasp.

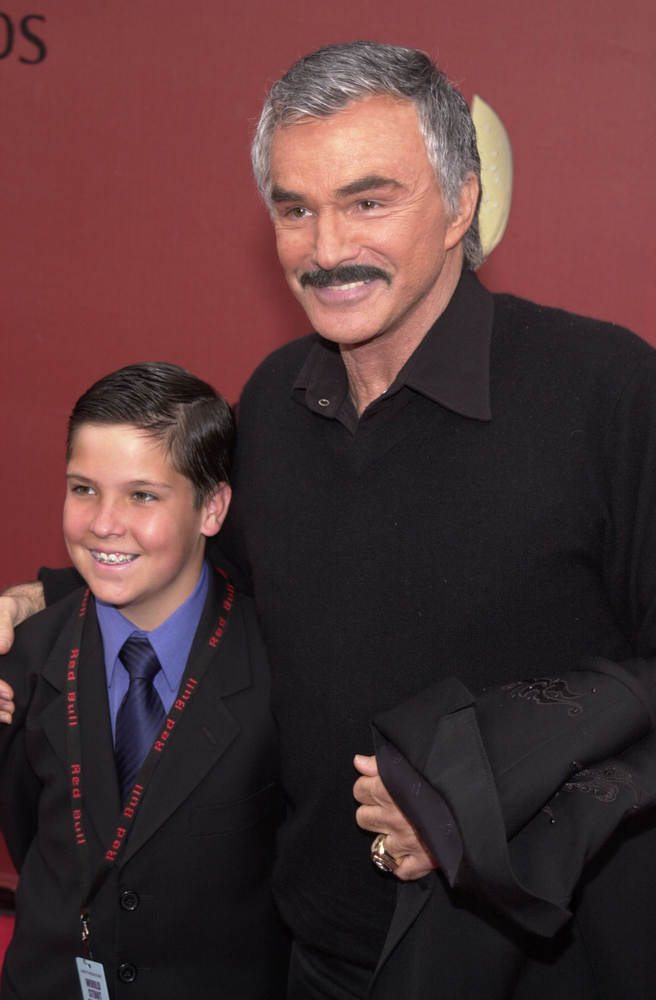

His personal life, similarly to his career, had its share of public attention. Marriages, relationships, and his role as a father were often discussed. It's fair to say, really, that he lived a life very much in the public eye, where every choice, it seemed, could become a topic of conversation.

Personal Details and Biography

To better understand the man and his decisions, here's a quick look at some key details about Burt Reynolds:

| Detail | Information |

|---|---|

| Full Name | Burton Leon Reynolds Jr. |

| Born | February 11, 1936 |

| Died | September 6, 2018 (aged 82) |

| Birthplace | Lansing, Michigan, U.S. |

| Occupation | Actor, Director, Producer |

| Spouses | Judy Carne (m. 1963; div. 1965), Loni Anderson (m. 1988; div. 1994) |

| Child | Quinton Anderson Reynolds (adopted) |

| Notable Works | Smokey and the Bandit, Deliverance, The Longest Yard, Boogie Nights |

The Will's Contents: What It Said

When Burt Reynolds passed away in 2018, his last will and testament became a topic of public interest. The document, which outlined how his assets would be handled, stated quite clearly that his adopted son, Quinton Anderson Reynolds, would not directly receive anything from his estate. This particular detail, you know, immediately sparked questions and speculation among his fans and the media.

The will specified that his niece, Nancy Lee Brown Hess, was named the personal representative of his estate. She was given the job of handling his affairs and making sure his wishes were carried out. This was a pretty significant role, as a matter of fact, placing a lot of responsibility on her shoulders.

Instead of a direct inheritance, the will actually stated that Quinton would be provided for through a trust. This distinction is quite important, as we'll talk about a little later. It suggests a different kind of financial arrangement, one that doesn't involve a direct payout but rather a managed fund.

The document also mentioned that any property not specifically listed in the will would go to his niece. This sort of blanket statement is common in wills, ensuring that no assets are left unaccounted for. So, pretty much, everything was going to be handled through this specific plan.

It's interesting to consider, too, that wills are public documents once they go through the probate process. This means that details like these become available for anyone to see. And that, in a way, is why these kinds of stories often become big news.

The phrasing of the will, you see, left little room for misinterpretation regarding Quinton's direct inheritance. It was a very deliberate choice, apparently, to structure his final financial arrangements in this particular manner. This kind of planning, in some respects, can be quite common for people with complex financial situations or specific goals for their heirs.

The language used in the will, as a matter of fact, was quite precise. It aimed to make it clear how his assets were to be distributed, or rather, not distributed directly to his son. This sort of careful wording is, basically, standard practice in legal documents of this nature.

So, the will itself didn't leave much to the imagination about the direct inheritance. It was, in short, a clear statement of his wishes regarding his immediate estate. And that, really, is what got people talking so much.

Understanding the Trust for Quinton

While the will stated that Quinton would not directly inherit from the estate, it also made it clear that he would be taken care of through a trust. This is a very important distinction, and it's actually a common practice in estate planning, especially for people with substantial assets or specific concerns about how funds might be used. A trust, you know, is a legal arrangement where assets are held by one party (the trustee) for the benefit of another (the beneficiary).

The specific details of the trust were not made public, but the general idea is that money or other assets are put into this separate fund. The trustee then manages these assets and distributes them to the beneficiary according to the rules set up by the person who created the trust. This could mean regular payments, payments for specific purposes like education or medical bills, or even payments upon reaching a certain age.

For Burt Reynolds, setting up a trust for Quinton could have been a way to ensure his son's financial well-being over the long term. It might have been a way to protect the money from potential creditors, or perhaps to make sure it was used responsibly. Sometimes, people choose trusts to prevent a large sum of money from being spent too quickly or unwisely. It's a way to provide support without handing over a lump sum directly.

This approach, in a way, shows a desire to provide for his son, just in a controlled manner. It's not the same as being "left out" entirely, even though the direct will might suggest that at first glance. It's more about a different method of provision, a structured way to offer financial backing.

Many celebrities, and really, many people with significant wealth, choose to use trusts for their heirs. It offers a degree of privacy that a will doesn't, since the trust's details often remain private, unlike a will which becomes public record. So, you see, there are many reasons why someone might choose this path.

The trust, apparently, was a separate entity from the direct will, designed to manage funds for Quinton's benefit. This arrangement, basically, offers a measure of control and protection for the assets, ensuring they are used as intended over time. It's a pretty common tool for estate planning, honestly, especially when someone wants to provide for a loved one without giving them immediate, unrestricted access to a large sum of money.

So, while the will didn't name Quinton as a direct heir, the trust was, in fact, the vehicle through which he would receive financial support. It's a distinction that, you know, really changes the whole picture of the situation. This method, you see, often reflects a thoughtful approach to ensuring long-term security for an heir.

This particular choice, in some respects, highlights the difference between a direct inheritance and a managed provision. It's a way to offer ongoing support, rather than a one-time distribution. And that, in a way, is a pretty significant detail when we talk about his final wishes.

Reasons Behind the Decision

The "why" behind Burt Reynolds' decision to provide for his son through a trust rather than a direct inheritance is, frankly, something that has sparked much discussion. While the specific, private reasons are known only to Burt and those closest to him, there are several common explanations for why someone might choose this path in their estate planning. One major reason, you know, often relates to financial responsibility.

Sometimes, a parent might worry about an heir's ability to manage a large sum of money. This isn't necessarily a reflection of a poor relationship or a lack of love. It could be a concern that a significant inheritance might be spent too quickly, or that the heir might become vulnerable to financial pressures. A trust, then, offers a way to distribute funds over time, or for specific needs, providing a safety net rather than a sudden windfall.

Another possible reason could be related to protecting the assets from external factors. For instance, if an heir has debts, or is going through a divorce, a trust can sometimes protect the inherited funds from being claimed by creditors or ex-spouses. This is a pretty common strategy, actually, for safeguarding family wealth.

There might also have been a desire to provide for Quinton's long-term care or specific needs, without burdening him with the complexities of managing a large estate. This is particularly true if the heir has special needs, or if the parent wants to ensure a steady income stream rather than a fluctuating one. It's a rather practical approach, in some respects.

It's also worth considering the possibility that Burt Reynolds had already provided for Quinton in other ways during his lifetime. Perhaps there were gifts, investments, or other arrangements made over the years that lessened the need for a direct inheritance in the will. We don't know the full extent of their private financial dealings, of course.

Some have speculated about the nature of their relationship. While Burt often spoke lovingly of Quinton, the dynamics of parent-child relationships, especially in the public eye, can be incredibly complex. However, there's no public indication that their relationship was strained in a way that would lead to a complete disinheritance. The trust arrangement, if anything, suggests continued care.

In fact, the will explicitly stated that the trust was established "for the benefit of my son, Quinton Anderson Reynolds." This phrasing, you know, pretty much indicates a clear intention to provide for him, even if not directly through the will itself. It’s a very important detail, honestly, that helps clarify the situation.

Financial stability, or rather, the lack of it at various points in Burt's life, could also play a part. He faced bankruptcy in the 1990s and had well-documented money troubles. It's possible he wanted to ensure that any remaining assets were managed in the most secure way possible for his son's future, learning from his own past experiences. So, in a way, it could have been a very thoughtful decision.

Ultimately, the exact reasons remain private, but these common estate planning considerations offer a good framework for understanding why such a decision might be made. It's not always about a lack of affection; sometimes, it's about a very practical approach to financial support. And that, really, is something to consider when you hear these kinds of stories.

The decision, you see, was likely rooted in a combination of factors, perhaps including a desire for responsible financial stewardship for his son. It's a pretty common reason for setting up trusts, honestly, to ensure that funds are managed wisely over time. This sort of planning, in some respects, is all about providing long-term security.

One might argue, too, that this approach shows a degree of foresight on Burt's part. He was, after all, someone who had seen the ups and downs of life and money. So, it's almost as if he wanted to shield his son from some of those potential pitfalls, by having the funds managed by others. That, basically, makes a lot of sense when you think about it.

The Son's Perspective and Public Reaction

Quinton Anderson Reynolds, Burt's adopted son, has largely maintained a private life, even after his father's passing and the public revelation of the will's contents. His reaction, you know, has not been widely publicized, which is pretty understandable given the personal nature of such matters. However, what we do know suggests a calm acceptance of his father's wishes.

Reports from those close to the family indicated that Quinton was aware of the trust arrangement and understood his father's intentions. This suggests that the decision wasn't a surprise to him, and perhaps it was even discussed between them at some point. It's a bit different, you see, when family members are kept in the loop about these kinds of plans.

The public reaction, on the other hand, was a mix of confusion and speculation. Many people immediately assumed that "leaving out of the will" meant a complete disinheritance, implying a strained relationship or a lack of care. This initial reaction, frankly, didn't always grasp the nuance of the trust arrangement.

Social media and news outlets buzzed with comments and theories. Some expressed sympathy for Quinton, while others defended Burt's right to manage his estate as he saw fit. It's interesting, isn't it, how quickly people form opinions based on limited information. The phrase "Why did Burt Reynolds leave his son out of will?" became a popular search, showing the intense curiosity.

Over time, as more details about the trust became known, some of the initial shock and misunderstanding began to fade. People started to realize that providing for someone through a trust is a valid and often thoughtful way to ensure financial support. It's not, basically, the same as cutting someone off entirely.

The situation highlights how easily public perception can be shaped by headlines, especially when it comes to celebrity estates. The true story, you know, often has more layers than what first appears. And that, in a way, is a lesson for all of us about jumping to conclusions.

Quinton himself has gone on to live his life away from the intense spotlight, reportedly working in the entertainment industry behind the scenes. This suggests a desire for privacy, which, as a matter of fact, is something many children of famous people often seek. So, you know, his quiet response is perhaps not that surprising.

The public's initial reaction, in some respects, really underscored how much people care about the idea of family and inheritance. It's a deeply personal topic, and when it involves a beloved public figure, the interest just naturally grows. And that, basically, is why these stories stick around.

This whole situation, you see, really shows how important it is to look at the full picture. It's easy to get caught up in the first bit of news, but the real story, as a matter of fact, often has more to it. And that, in a way, is pretty much what happened here.

The general public, you know, tends to react quite strongly to news about wills, especially when it involves a famous person's family. It's almost as if people feel a connection to these figures, and so, the details of their private lives become a point of discussion. And that, honestly, is pretty typical for celebrity news.

The Broader Picture: Celebrity Estates and Planning

The case of Burt Reynolds' will is, in a way, a good example of how celebrity estates often become public spectacles. When famous individuals pass away, their financial arrangements and last wishes frequently come under intense scrutiny. This is partly because of public curiosity, but also because, as a matter of fact, wills are generally public documents once they enter the probate court system.

Many celebrities, you know, face unique challenges when it comes to estate planning. They often have complex financial portfolios, including royalties, intellectual property rights, and various investments. They also have to consider their public image and the potential for family disputes. This is why careful planning, sometimes involving trusts and other legal structures, is absolutely crucial.

For some, the goal is to minimize taxes, while for others, it's about ensuring a legacy, or providing for specific family members in a controlled way. The use of trusts, as we've discussed, is a very common tool in these situations. It allows for privacy regarding the distribution details and can offer protection for assets. It's a pretty smart move, honestly, for many wealthy individuals.

The public fascination with celebrity wills also stems from a desire to understand the personal dynamics within these famous families. People often project their own family values and expectations onto these situations. When a will deviates from what the public might expect, like in Burt Reynolds' case, it sparks intense interest and discussion. It's just human nature, you see, to be curious about these things.

There are countless examples of celebrity wills that have caused a stir, from disputes over fortunes to surprising beneficiaries. These stories, you know, often highlight the importance of clear, legally sound estate planning. Without proper documentation, a person's final wishes can become a source of contention and lengthy legal battles for their loved ones. So, it's pretty much a big deal to get it right.

The media, too, plays a significant role in how these stories unfold. Headlines often focus on the most dramatic or unexpected elements, which can sometimes overshadow the true intentions behind the decisions. This is why, in a way, understanding the full context, like the use of a trust, is so important.

For anyone thinking about their own future, these celebrity stories, as a matter of fact, offer a pretty good lesson. They show that planning ahead, and making your wishes clear, can save a lot of heartache for those you leave behind. It's a very practical consideration, honestly, for everyone, not just famous people.

The interest in these types of stories, you know, really just shows how much people connect with the idea of legacy and family. It's almost as if we want to understand the private lives of those we admire, and their final arrangements are a very personal window into that. And that, in a way, is why these topics stay relevant for a long time.

So, basically, the way Burt Reynolds handled his estate is not unique among celebrities. Many, many famous people use similar methods to manage their wealth after they're gone. It's a very common approach, honestly, for protecting assets and providing for family members in a structured way. And that, you know, is a key takeaway from this whole discussion.

What We Can Learn from This Story

The story of Burt Reynolds' will and his provisions for his son, Quinton, offers several interesting points to think about. First off, it really highlights how important it is to look beyond the initial headlines. What might seem like a straightforward "disinheritance" can actually be a carefully planned financial arrangement, like a trust. So, you know, things are often more complex than they appear at first glance.

Secondly, it shows that providing for loved ones doesn't always mean handing over a direct lump sum of money. Trusts, as a matter of fact, are a very flexible tool that can ensure long-term support, protect assets, and guide how funds are used over time. This can be a particularly thoughtful way to manage an inheritance, especially for parents who want to ensure their children's financial stability in

Detail Author:

- Name : Prof. Tomas Hegmann

- Username : sienna61

- Email : oconnell.damon@hotmail.com

- Birthdate : 1972-05-15

- Address : 21548 DuBuque Harbors Apt. 349 Ullrichberg, MO 92027-5928

- Phone : +16299220678

- Company : Deckow Ltd

- Job : Brake Machine Setter

- Bio : Praesentium reiciendis dolorem est aspernatur sequi neque ratione. Et suscipit eos hic aperiam. Sit occaecati nihil at. Quo non adipisci pariatur quae laboriosam est error dicta.

Socials

instagram:

- url : https://instagram.com/manuel_official

- username : manuel_official

- bio : Enim ipsa quis qui esse dicta. Ipsum sequi et odit et voluptas exercitationem.

- followers : 5313

- following : 1951

tiktok:

- url : https://tiktok.com/@hahnm

- username : hahnm

- bio : Error earum eum suscipit aut voluptatem nam. Et facilis nemo beatae provident.

- followers : 4438

- following : 292

facebook:

- url : https://facebook.com/hahn2006

- username : hahn2006

- bio : Facilis quidem dolorem voluptate animi commodi earum.

- followers : 4914

- following : 2188