Thinking about stepping away from Afterpay? It's a common thought for many people looking to adjust their financial habits or simplify their digital life. Taking control of your spending tools can feel really good, and figuring out how to deactivate Afterpay is a big step in that direction. Perhaps you're looking for more traditional ways to manage purchases, or maybe you just feel it's time for a change. Whatever your personal reasons, getting clear on how to manage your accounts is always a smart move.

For many, the appeal of "buy now, pay later" services is clear: they offer a flexible way to spread out costs. Yet, over time, some folks find that these services might not quite align with their long-term financial goals, or perhaps they've just moved on to different ways of handling their money. It's almost like, you know, when you decide to clean out your digital wallet, you want to make sure everything is sorted.

This guide is here to walk you through the process of deactivating your Afterpay account. We'll cover what you need to think about before you start, the actual steps involved, and what happens once your account is no longer active. So, if you're ready to make this change, we've got the details you'll need, very clearly laid out for you.

Table of Contents

- Why Consider Deactivating Afterpay?

- What to Do Before You Deactivate

- The Steps to Deactivate Your Afterpay Account

- What Happens After Deactivation?

- Can You Reactivate Your Afterpay Account?

- Alternatives to Full Deactivation

- Frequently Asked Questions

Why Consider Deactivating Afterpay?

There are many reasons why someone might decide to stop using a service like Afterpay. For some, it's about gaining a tighter grip on their spending. Having easy access to credit, even interest-free, can sometimes lead to purchases that weren't quite planned. You know, it's pretty easy to get carried away when the immediate cost seems so small.

Others might find they just don't use it much anymore. Perhaps their shopping habits have changed, or they've found other payment methods that suit them better. It's like, why keep an app on your phone if it's just sitting there taking up space, right? Removing unused accounts can also feel like a digital declutter.

Then there are those who are concerned about their financial well-being. Keeping too many credit lines open, even if they're not traditional loans, can sometimes affect how you view your money. It's a bit like having too many open tabs on your browser; it can feel a little overwhelming. Deactivating an account can be a deliberate choice to simplify your financial landscape and avoid potential overspending.

Some users might also have privacy concerns, wishing to reduce the number of companies holding their personal and financial data. In a world where data security is increasingly important, limiting your digital footprint is a very sensible approach. So, for these reasons and more, choosing to deactivate Afterpay can be a thoughtful personal finance decision.

What to Do Before You Deactivate

Before you go ahead and close your Afterpay account, there are a few important things you really should take care of. This helps make sure the process goes smoothly and that you don't run into any unexpected issues later on. It's sort of like preparing your car for a long trip; you check the oil and tires first, you know?

Outstanding Payments First

The most important step is to make sure you have no outstanding payments or active orders. Afterpay will not let you deactivate your account if you still owe them money. This is a pretty standard policy for any financial service. You'll need to pay off any remaining balances in full before you can proceed.

You can check your payment schedule and current balance within the Afterpay app or on their website. Make sure every single payment has been processed and cleared. Sometimes, a payment might show as pending for a little while, so it's good to give it a day or two after your final payment clears to be absolutely sure. This ensures a clean break, you see.

Linked Payment Methods

You might also want to remove any linked debit or credit cards from your Afterpay account before deactivating. While deactivation should take care of this, it's a good practice for your own peace of mind. This step is a bit like unlinking your payment method from an old subscription service you no longer use, just to be extra careful.

Go into your account settings, find the payment methods section, and remove any cards you have stored there. This is a quick way to ensure your financial details are no longer connected to the service once you're done. It's a small step, but it helps ensure everything is tidied up, really.

Data and Account History

Consider if you need any of your transaction history or account data for your personal records. Once your account is deactivated, you might not be able to access this information as easily, or at all. So, if you keep track of your spending for budgeting or tax purposes, it's a good idea to download or screenshot what you need.

Afterpay's privacy policy will detail how long they retain your data after deactivation, but for your own records, having a copy is always smart. This is especially true if you've used Afterpay for significant purchases. It's similar to saving old bank statements; you might not look at them often, but it's good to have them if a question comes up. You know, just in case.

The Steps to Deactivate Your Afterpay Account

Deactivating your Afterpay account is a process that typically requires you to reach out to their customer support team. Unlike some other apps where you might find a "delete account" button right in the settings, Afterpay usually handles deactivations directly. This approach ensures that all outstanding issues are resolved before the account is closed for good. It's a bit like how, as a matter of fact, some software updates for Windows 10 require you to go through a specific process, rather than just clicking a single button, if you want to, say, turn on or off Microsoft Defender Firewall.

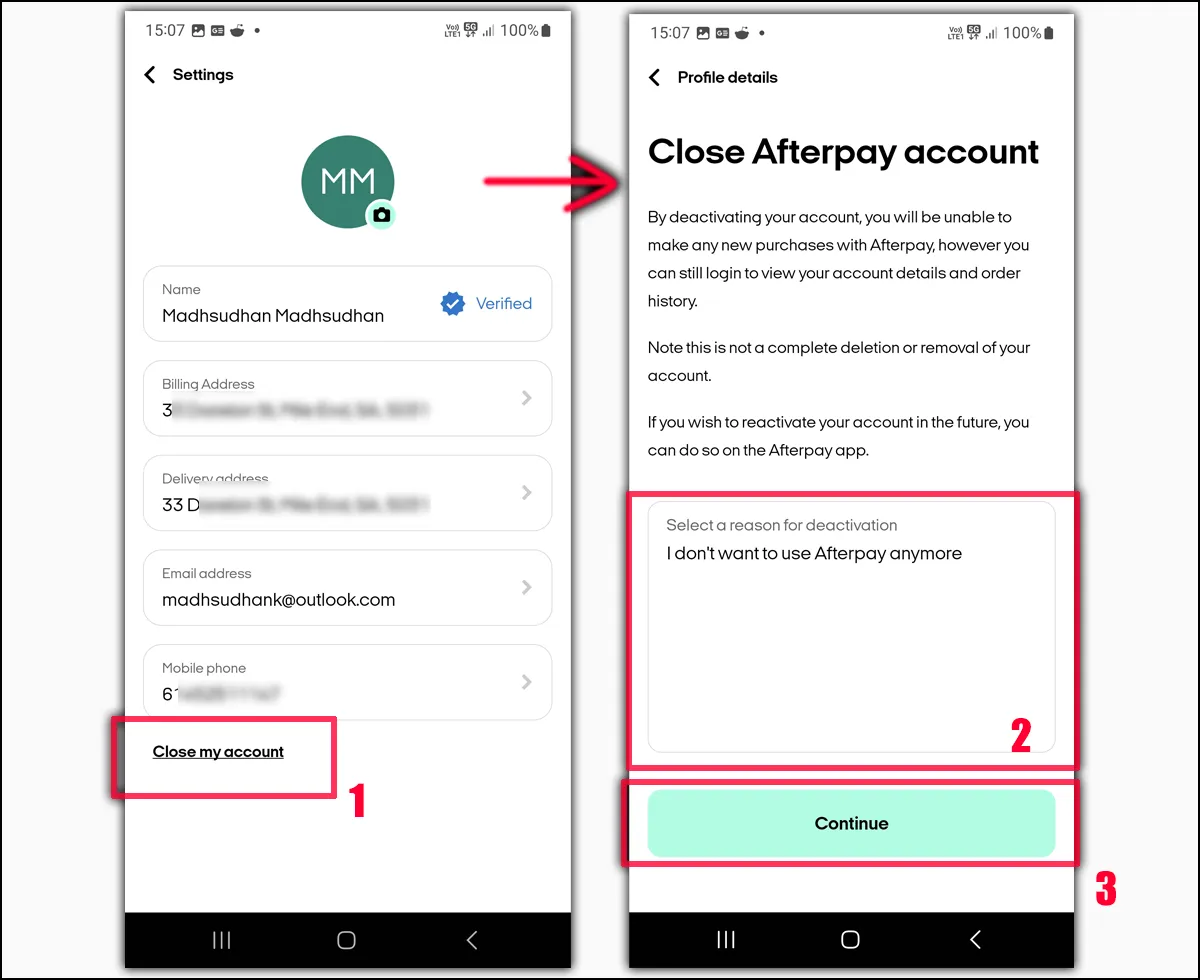

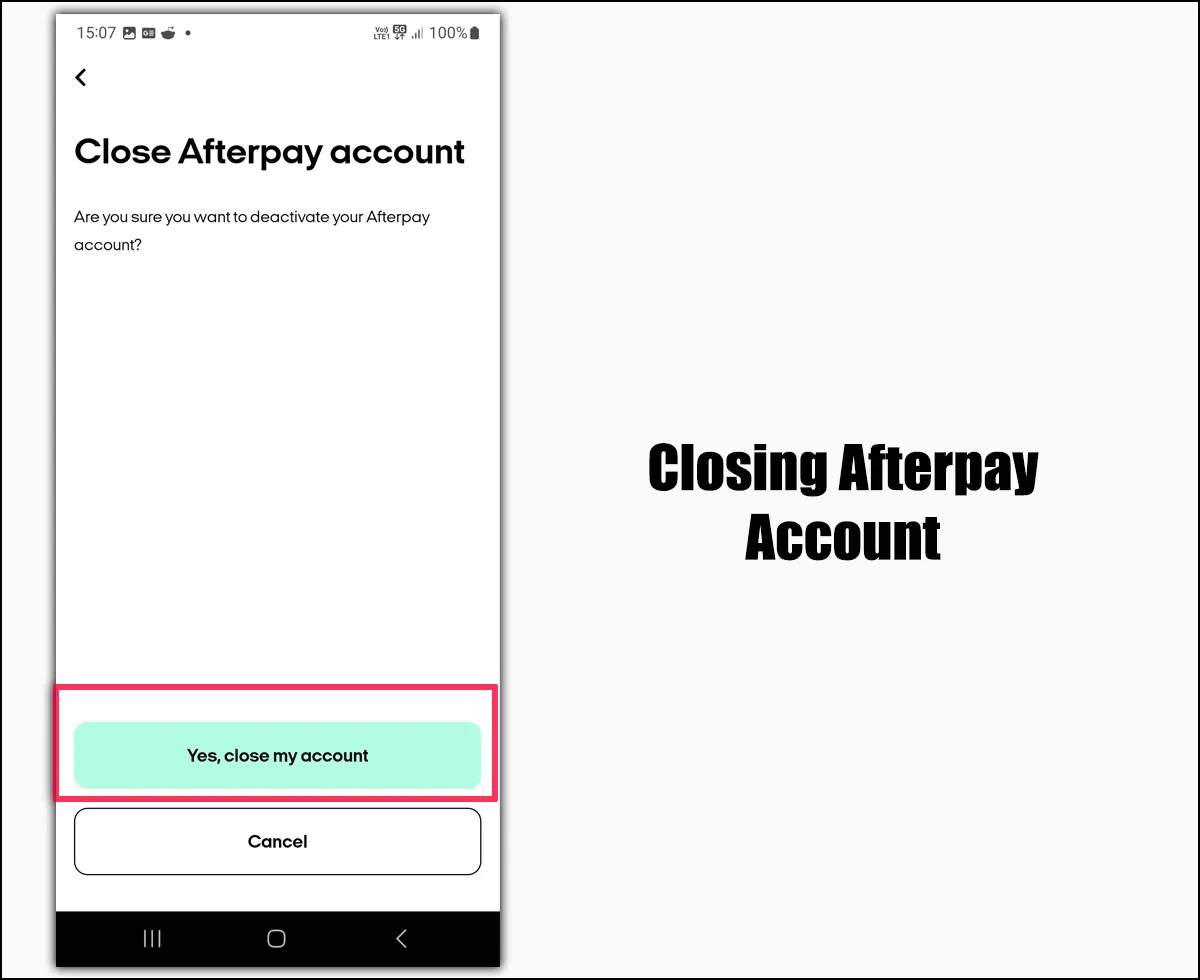

Via the Afterpay App

While there isn't a direct "deactivate" button in the app, you can start the process by using the app's help or support features. This is often the quickest way to get in touch with the right people. You'll want to navigate to the "Help" or "Support" section, which is usually found within the main menu or profile settings.

Once there, look for options like "Contact Us" or "Submit a Request." You'll then typically be able to send a message or fill out a form explaining that you wish to deactivate your account. Be sure to clearly state your intention and provide any necessary account details they might ask for to verify your identity. This helps them confirm it's really you making the request, you know.

They might then guide you through any final steps or confirm that your account is clear of payments. They will likely send you an email with further instructions or confirmation. It's a pretty straightforward way to get the ball rolling, especially since most people use the app for their daily interactions with Afterpay.

Through the Website

The Afterpay website also offers ways to contact support to initiate deactivation. This method is quite similar to using the app, but some people prefer using a desktop browser for these kinds of tasks. Go to the official Afterpay website and look for a "Help," "Support," or "Contact Us" link, usually found in the footer or header of the page.

You might find a dedicated help center with articles, and within that, an option to submit a support ticket or start a live chat. Just like with the app, clearly state that you want to deactivate your account. They will then guide you through the necessary verification steps and confirm that your account is ready for closure. This is a really good option if you prefer typing out a longer message or if you're having trouble with the app for some reason.

Contacting Customer Support Directly

If you prefer a more direct approach or if the app/website methods aren't working for you, you can try to find Afterpay's customer support phone number. While phone support might not always be available for deactivation requests, it's worth checking their "Contact Us" page for this option. Some people, quite frankly, just prefer talking to a person.

When you speak with a representative, clearly state your request to deactivate your account. Be prepared to answer security questions to verify your identity. They will then be able to confirm if your account is eligible for deactivation (i.e., no outstanding payments) and guide you through the final steps. This can be a very efficient way to get things done, especially if you have specific questions about the process.

Remember, the key is to ensure all your payments are clear before you reach out. Once that's handled, Afterpay's support team can help you finalize the deactivation. It's a process designed to protect both you and the service, ensuring everything is settled properly. You know, like when you uninstall a product key to deactivate Windows 10 activation, there's a specific order of operations.

What Happens After Deactivation?

Once you've gone through the steps and Afterpay confirms your account is deactivated, you might wonder what exactly happens next. It's good to have a clear picture of what to expect so there are no surprises. This part is pretty important for understanding the full scope of your decision, you know.

Account Status Changes

First and foremost, your Afterpay account will no longer be active. This means you won't be able to make new purchases using Afterpay. You also won't be able to log into your account, view past orders, or manage any payment methods. It's effectively closed off from your access, more or less.

Any linked payment methods will be disconnected from the service. If you had any saved shopping carts or wishlists within the Afterpay platform, those will also be gone. Your relationship with Afterpay as an active user comes to an end. This is the main goal of deactivation, after all, to stop using the service.

Data Retention Policies

While your account is deactivated, Afterpay, like most financial service providers, will still retain some of your data for a certain period. This is typically done for legal, regulatory, and operational purposes, such as record-keeping, fraud prevention, and compliance with financial laws. They can't just completely erase everything instantly, apparently.

The exact duration and type of data retained will be outlined in Afterpay's privacy policy. It's a good idea to review this policy if you have specific concerns about your data. They usually keep things like transaction records and basic account information for a set number of years, just as a matter of fact. So, while your account is inactive, some of your information will still exist on their systems for a while.

Future Communications

You should expect to receive a confirmation email once your account has been successfully deactivated. This email is your official notice that the process is complete. It's a pretty important message to keep for your records, too.

After that, you should stop receiving marketing emails or notifications from Afterpay. If you continue to receive them, it might be worth checking your spam folder or contacting their support again to ensure you've been fully removed from their mailing lists. It's basically a sign that your request has been fully processed and you're no longer considered an active customer. So, that's a good thing.

Can You Reactivate Your Afterpay Account?

A common question people have after deactivating is whether they can ever come back and use Afterpay again. The answer is, generally, yes, but it's not always as simple as just logging back in. It depends on Afterpay's internal policies and the specific circumstances of your deactivation, you know.

If you decide at some point in the future that you'd like to use Afterpay again, you would typically need to apply for a new account. This is because your previous account has been closed. You won't just be "turning it back on" like you might with a setting on your phone. It's more like starting fresh, in a way.

The process would involve going through their standard sign-up procedure again. Afterpay would then assess your eligibility based on their current criteria, which might include a soft credit check and other factors. There's no guarantee that a new application will be approved, even if you had an account before. So, while it's often possible, it's not an automatic reactivation. It's pretty much a new application, as I was saying.

Alternatives to Full Deactivation

Perhaps you're thinking about deactivating Afterpay, but you're not entirely sure if it's the right step for you just yet. There are, actually, a few other options you might consider before completely closing your account. These alternatives can give you more control without making a permanent decision. It's like having a dimmer switch instead of just an on/off button, right?

One very simple alternative is to just stop using the service. You don't have to deactivate your account to stop making purchases. If you simply remove the app from your phone and avoid using Afterpay at checkout, you'll naturally reduce your reliance on it. This is a pretty effective way to break the habit without formal closure. You know, out of sight, out of mind, sometimes.

Another option is to remove your linked payment methods. By doing this, even if you were tempted to use Afterpay, you wouldn't have a quick way to complete a purchase. This adds a small barrier that can make you think twice before buying. It's a good way to slow down impulse buys, if that's something you're working on. This gives you, like, a moment to pause.

If your concern is about managing payments, Afterpay also offers options to adjust payment schedules or make early payments. If you're finding it hard to keep up, reaching out to their support for a payment plan adjustment might be a better solution than deactivation. This is especially true if you have outstanding balances you're trying to manage. It's worth exploring these options before making a final decision, really.

These alternatives can give you a chance to see if you truly want to stop using Afterpay long-term, or if you just need a temporary break or a different way to manage your current usage. They offer flexibility, which is often what people are looking for when they consider changing their financial habits. So, consider these points before you decide to deactivate Afterpay completely.

Frequently Asked Questions

Can I just stop using Afterpay without deactivating?

Yes, absolutely. You can simply choose to stop making purchases with Afterpay at any time without formally deactivating your account. As long as you have no outstanding payments, your account can remain open but inactive. This is a very common choice for many people who just want a break from using the service. You know, it's like keeping an old email account open, even if you don't use it daily.

What happens to my outstanding payments if I deactivate?

Detail Author:

- Name : Jadyn Hettinger PhD

- Username : lane.steuber

- Email : qkunze@robel.com

- Birthdate : 2001-11-07

- Address : 8586 Altenwerth Oval Hayesmouth, VT 32866

- Phone : +1-404-867-1502

- Company : Jakubowski LLC

- Job : Typesetter

- Bio : Aut cum iusto nemo ex unde. Et blanditiis est saepe mollitia. Maxime debitis quam dolores.

Socials

facebook:

- url : https://facebook.com/stanheller

- username : stanheller

- bio : Vel quasi itaque id deserunt et voluptatem in.

- followers : 475

- following : 603

linkedin:

- url : https://linkedin.com/in/heller1987

- username : heller1987

- bio : Unde velit rerum in voluptas omnis sunt.

- followers : 2806

- following : 2041

instagram:

- url : https://instagram.com/heller1986

- username : heller1986

- bio : Aperiam nam laborum aperiam voluptas in et. Voluptatum pariatur veniam numquam aut.

- followers : 251

- following : 1433