It's a question many folks ask, particularly as that little date on their credit card gets closer. You might be looking at your plastic, seeing "08/25" for instance, and wonder, "Does credit card expire at end of month, or is it on a specific day in August?" This thought can cause a bit of worry, especially if you have bills set up for automatic payments or plans for a big purchase. Knowing exactly when your card stops working is pretty helpful, so you are not caught off guard.

For a lot of us, our credit cards are a big part of how we manage daily expenses and bigger purchases, too. They are, you know, just a regular part of how things get done financially. So, when that expiration date looms, it is totally natural to feel a little unsure about what happens next. You might even ask yourself, "What does that date really mean for my spending?"

We are going to look closely at this common question and clear up any confusion you might have. We will talk about what happens when your card gets close to its expiration date, what you should do, and how new cards usually arrive. It is all about making sure your financial life stays smooth, so you can keep using your card without any unexpected hiccups, in a way.

Table of Contents

- Understanding Credit Card Expiration Dates

- What Happens When Your Card Expires?

- Getting a New Card

- Updating Your Information

- Frequently Asked Questions

- Staying Ahead of the Game

Understanding Credit Card Expiration Dates

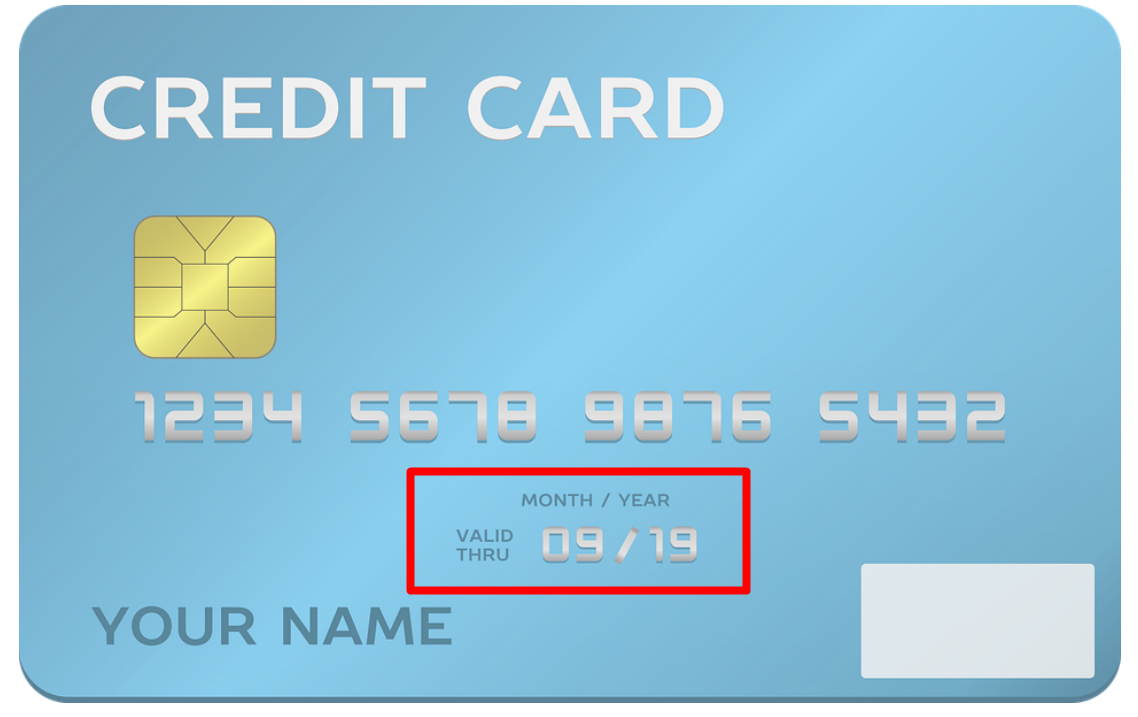

When you look at your credit card, you will typically see a date formatted as MM/YY, like 08/25 or 12/26. This date is the expiration date for your card, you know, pretty straightforward. It tells you when the physical piece of plastic is no longer valid for use. Many people wonder if the card stops working on the first day of that month, or maybe even on a specific day within it. That is a really common thought, actually.

The good news is, for nearly all credit cards, the expiration date means the card is good until the very last day of the month shown. So, if your card says "08/25," it means it is perfectly fine to use through August 31, 2025. It will stop working on September 1, 2025, more or less. This gives you a bit of breathing room, which is pretty nice.

This system is pretty standard across the financial world, you know. It helps make things simpler for both cardholders and the companies that process payments. It is just how things are set up, so there is no confusion about a specific day in the middle of the month. It is always the end, which is a bit of a relief for many.

The reason cards have an expiration date is actually quite practical. It is not just to make you get a new card, you know. Over time, the physical card can wear out, the magnetic strip might get damaged, or the security features could become outdated. A new card ensures you have the latest technology and a fresh, working piece of plastic. It is, in a way, a little refresh for your payment method.

Think about it, too. This regular update also helps with security. It means your card number, while often staying the same, is tied to a physical card that has a limited lifespan. This helps reduce the chances of very old, perhaps compromised, card details being used indefinitely. It is a small but important part of keeping your money safe, so it is.

So, when you see that date, just remember it means "good until the end of this month." It is not some mystery date that changes daily. It is a clear, simple marker for when your card's journey reaches its natural conclusion, you know. And that is pretty much how it works for everyone.

What Happens When Your Card Expires?

Once your credit card reaches its expiration date, meaning after the very last day of the month printed on it, it generally stops working for new purchases. This is a pretty important detail to remember. If you try to use it in a store or online, the transaction will likely be declined. It is, you know, just how the system is set up to handle expired cards.

This can be a little surprising if you are not expecting it, especially if you are in the middle of checking out somewhere. The card simply will not process the payment. It is almost like it suddenly becomes a piece of plastic that looks like a credit card but does not function as one anymore. That is why knowing the date is so important, actually.

The bank or credit card company does this to make sure only active, up-to-date cards are in circulation. It helps them manage their accounts and also helps protect you. An expired card cannot be used by someone else if it gets lost or stolen, which is a good thing, really. It adds another layer of security, you know.

Impact on Recurring Payments

One of the biggest concerns for many people is how an expiring card affects their recurring payments. Think about your streaming services, gym memberships, utility bills, or even online subscriptions. These services often have your card details saved on file, and you might not think about them until there is an issue. This is, in some respects, a very common worry.

When your card expires, these automatic payments will almost certainly fail. Most companies that process recurring charges will check the expiration date. If it is past due, the payment will not go through. This can lead to missed payments, late fees, or even service interruptions. It is, you know, a bit of a hassle if you are not prepared.

Some companies, especially the larger ones, might try to update your card information automatically through a service called an "account updater." This service allows them to get your new card number and expiration date directly from your bank without you having to do anything. It is a pretty handy feature, but it does not always work, you know.

It is always a good idea to check with each service that has your card on file. Do not just assume the update will happen. Log into your accounts or give them a quick call to manually update your card details once your new one arrives. This simple step can save you a lot of trouble and prevent any interruptions to your services. It is just, like, a good habit to get into.

This is where that distinction between "do" and "does" comes in, in a way, for your actions. What "do" you do to prevent issues? You "do" update your information. What "does" the bank do? It "does" send a new card. See how the subject changes the verb? It is a small but important difference, you know, in how we talk about these things.

Using an Expired Card

As we mentioned, trying to use an expired credit card for new purchases, whether online or in person, will almost always result in a declined transaction. The payment system is designed to reject these attempts. So, if you are at the checkout and your card says "expired," it simply will not work. That is, you know, just how it goes.

Even if you have the funds available, the card itself is no longer considered valid by the processing networks. It is not about your credit limit or your balance; it is purely about the card's validity date. This can be a bit embarrassing if you are out shopping, so it is always better to be prepared. You do not want to be caught off guard, really.

For online purchases, you might get an error message saying something like "card expired" or "invalid expiration date." The system will not let you proceed with the purchase. This is, you know, a pretty clear signal that you need to use a different card or update your details. It is just a part of the online security process.

What you should definitely not do is try to alter the expiration date on your old card. That is, you know, absolutely not allowed and could lead to serious problems. It is much better and safer to wait for your new card to arrive or contact your bank if it is taking too long. Just be patient, and the new card will come, usually.

So, the takeaway here is pretty simple: once the calendar flips past the expiration month, that old card is basically just a piece of plastic with no power. It is not going to work for buying things, which is why getting the new one activated is so important. It is, like, the key step, you know.

Getting a New Card

The good news is that credit card companies are pretty good about sending you a new card before your old one expires. They do not want you to have any interruptions in your ability to use their services, after all. This process is usually automatic, which is pretty convenient for cardholders. It is, you know, just part of the service.

Typically, your new card will arrive in the mail a few weeks before your current card's expiration date. For example, if your card expires in August 2025, you might receive your new card sometime in July 2025. This gives you plenty of time to activate it and update any recurring payments. It is, like, a thoughtful little window they give you.

The new card will usually have the same account number, but it will have a new expiration date and a new three or four-digit security code (CVV/CVC). This new security code is important for online purchases and phone transactions. It is, you know, a key security feature that changes with each new card. So, do not forget to note it.

Automatic Renewal Process

For most credit card accounts, the renewal process is automatic. You do not typically need to call your bank or request a new card. The bank will simply issue a new one and mail it to your address on file. This is, you know, a pretty seamless process that most people appreciate. It just happens behind the scenes.

However, it is super important to make sure your mailing address with your credit card company is up to date. If you have moved recently and have not updated your address, your new card might be sent to your old home. This could cause delays and, in some cases, security risks. So, a quick check of your address is always a good idea, actually.

If you are traveling or will be away from your usual address around the time your card is set to expire, it is a good idea to contact your bank. You might be able to arrange for the card to be sent to a different address or hold it for pickup. This can prevent any issues while you are away. It is, you know, a simple call that can save a lot of headaches.

This automatic process is designed to be as hassle-free as possible for you. The banks want to keep you as a customer, so they make it easy to continue using their services. It is, you know, just good business practice, really. They are, in some respects, making sure you are taken care of.

What to Do If Your New Card Does Not Arrive

While the automatic renewal process usually works very well, sometimes things can go a little sideways. If your credit card is approaching its expiration month and you have not received your new card, it is time to get in touch with your bank. Do not wait until the last minute, you know.

Give your credit card company a call a few weeks before the expiration date. Let them know you have not received your new card. They can check the status of the shipment and confirm your mailing address. They might be able to track it or send out a replacement immediately. It is, like, their job to help you with this.

It is possible the card was lost in the mail, or perhaps there was an issue with your address on file. Whatever the reason, your bank can help sort it out. They might even be able to provide you with a temporary card number for online use while you wait for the physical card. This can be very helpful, you know, if you need to make purchases.

Staying proactive here is key. You do not want to be in a situation where your current card expires and you have no replacement. That could cause a lot of inconvenience. So, if that new card is not showing up when you expect it, just pick up the phone. It is a simple step that can prevent a lot of stress, you know, pretty much.

Activating Your New Card

Once your shiny new credit card arrives, the very next step is to activate it. This is super important. Your new card will not work until you complete the activation process. This is a security measure to make sure the card has reached the right person. It is, you know, just a smart way to keep your money safe.

Activation is usually very simple. Most cards come with a sticker that has a phone number to call for activation. You might also be able to activate it online through your bank's website or mobile app. Sometimes, you can even activate it by making a purchase and entering your PIN. Just follow the instructions that come with the card, you know.

During activation, you might be asked to confirm some personal information to verify your identity. This is normal and helps protect your account. Once activated, your old card will officially become inactive, if it was not already. So, you can then safely dispose of your old card. It is, like, the final step in the process.

Remember to sign the back of your new card as soon as you get it. This is another small but important security step. An unsigned card is often considered invalid by merchants. So, a quick signature makes your card ready for use. It is, you know, just a good habit to get into.

After activation, remember to update any recurring payments you have set up. Even if your account number stayed the same, the new expiration date and security code will need to be updated with those services. This is a crucial step to avoid any missed payments or service interruptions. It is, you know, a little bit of work but totally worth it.

Updating Your Information

Beyond activating your new card, there is a crucial step that many people sometimes forget: updating your card details everywhere they are saved. This is, you know, pretty important for a smooth financial life. It is not just about the card in your wallet, but also the digital versions.

Think about all the places your card information might be stored. This could include online shopping sites like Amazon or your favorite clothing store, ride-sharing apps, food delivery services, and even digital wallets like Apple Pay or Google Pay. Each of these places needs to have your most current card details. It is, you know, a bit of a list to go through.

If you do not update your information, you might find yourself unable to complete a purchase online or use your digital wallet. The old expiration date will cause the transaction to fail. This can be pretty frustrating, especially if you are in a hurry. So, a quick check and update can save you a lot of bother, actually.

Take a few minutes after activating your new card to log into your most frequently used online accounts. Go to the payment settings section and update the expiration date and the new security code. Some services might even let you update your card with a simple click if they use an account updater service, but it is always best to double-check. It is, you know, just being careful.

For digital wallets, you will need to remove the old card and add the new one. This ensures that when you tap your phone or watch to pay, the correct and active card information is being used. It is a pretty simple process, but it is easy to overlook. So, make sure you do it, you know.

This proactive approach helps you avoid any unexpected declines or issues. It keeps your financial world running smoothly without any sudden bumps in the road. It is, in some respects, about staying on top of your game. You are, like, managing your money really well.

Frequently Asked Questions

People often have very similar questions about credit card expiration. Here are a few common ones, you know, just to help clear things up even more.

Does a credit card expire on the exact date or end of the month?

A credit card expires at the very end of the month shown on the card. So, if your card says "08/25," it is good until August 31, 2025. It will stop working on September 1, 2025. It is, you know, always the last day, which is good to know.

What happens if I use an expired credit card?

If you try to use an expired credit card for a purchase, whether online or in a store, the transaction will almost certainly be declined. The payment system will recognize that the card is no longer valid. It is, you know, just how the system is designed to work.</

Detail Author:

- Name : Erika Medhurst

- Username : wjones

- Email : lon.wolff@gmail.com

- Birthdate : 1986-08-07

- Address : 10168 Rogahn Mill West Douglas, RI 12208

- Phone : 320.956.5027

- Company : Stiedemann, Nitzsche and Hoppe

- Job : Fiberglass Laminator and Fabricator

- Bio : Similique assumenda molestiae ullam omnis. Cum nihil et omnis consequatur sed. Rerum nulla dolor qui nostrum suscipit repellendus. Nam nobis fugiat ut non nemo.

Socials

tiktok:

- url : https://tiktok.com/@aoberbrunner

- username : aoberbrunner

- bio : Natus et illum veniam quisquam qui veniam ducimus.

- followers : 1819

- following : 1823

instagram:

- url : https://instagram.com/araceli4579

- username : araceli4579

- bio : Id qui ea expedita. Illo praesentium occaecati consectetur quis maxime in.

- followers : 344

- following : 2012

linkedin:

- url : https://linkedin.com/in/araceli_official

- username : araceli_official

- bio : Eligendi necessitatibus dolorem corporis.

- followers : 464

- following : 2272